- theoretically service their mortgage at a 5% p.a. interest.

- account for 1% amortization (i.e. loan repayment) per year.

- afford between 0.5% and 1% in house maintenance costs.

- keep the costs for housing to 33% of their income.

Buying a house in Switzerland

April 3, 2022

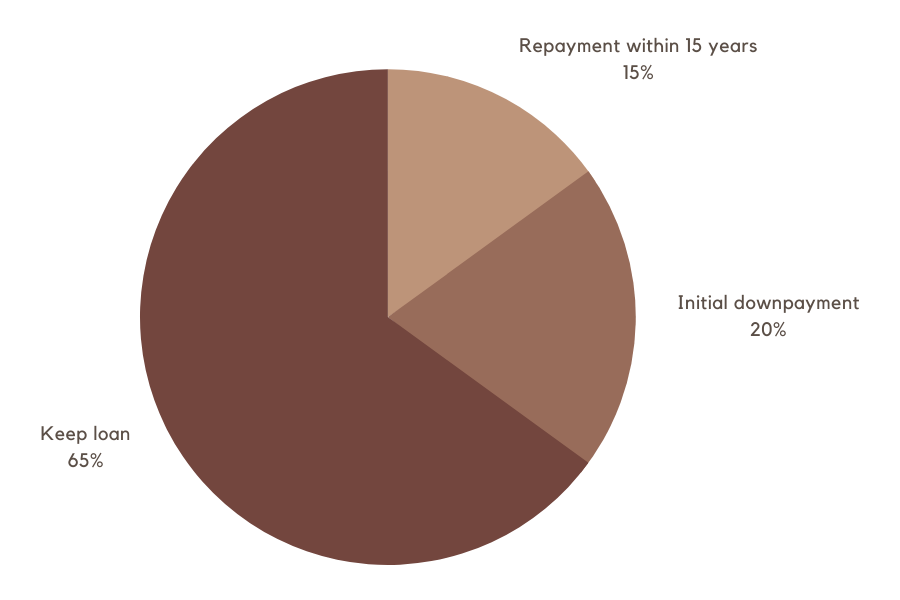

Buying a house anywhere is a complicated process and Switzerland is no exception. The tax laws however are a little different to what one might be used to elsewhere. The most important legal/cultural difference is that one can potentially keep 65% of their initial mortgage forever, i.e. there is no legal requirement to pay off the mortgage. This is actually a simple reflection of the fact that given the cost of housing relative to income, for most people it is almost impossible to actually pay off the mortgage in a realistic amount of time :). Moreover, the tax laws are framed as such that it can potentially make more sense to keep the mortage, invest the money in higher returns and at the same time use the interest payments to offset income tax!

Mortgage breakdown

As an example, with a house purchase of 1.5 million, a 300,000 downpayment and a 1.2 million mortgage, most banks require that one could potentially earn enough yearly in order to be able to afford: 60,000 CHF in interest + 12,000 CHF amortization + 12,000 CHF for house maintenance. This yearly amount needs to be no more than 33% of the income. Thus, to compute how much of a mortgate can one get, the formula is: (Net Income / 3) * (1 / 0.07) * (1 / 0.8). Plugging in 200,000 CHF into the formula yields ~ 1.2 million CHF :).

This handholding can be a bit strange but it would seem that the banks have been burnt before and do not want to take chances anymore. In a sense this is good as it automatically ensures that the buyers are fiscally responsible but it also adds a lot of extra gatekeeping in regards to wealth generation. Anyhow, as of 3rd April 2022, the 10yr rates are hovering around the 1% mark. Historically however, they have been between 3 and 7 percent.

Other fees

- Notary Fees

- Property Transfer Fees

- Real Estate Acquisition Taxes

- etc.

Overall, one can expect to pay about 5% of the house value in extra fees. It is very important to consider these fees since they will need to be paid in cash. In some cases, some banks may accept to take this into the mortgage, but it is rare.

Tax breakdown

- Property Tax: Sometimes known as land or real estate tax, this is a cantonal or communal tax on land and buildings (Liegenschaftssteuer, impôt foncier). It is payable by persons who are recorded in the land register as the owners or users of a property. Generally speaking, the rates range from 0.05% to 0.3% on the full taxable value of the property, i.e. without taking account of any related debts or mortgages. The property is taxed at its location irrespective of where the owner lives. Certain cantons (ZH, SZ, GL, ZG, SO, BL and AG) do not levy this tax.

- Imputed rental value: If you live in your own home, you must pay income tax on the so-called imputed rental value (Eigenmietwert, valeur locative). The imputed rental value is approximately 60 to 70 per cent of the rent that would be payable on the property if it were leased on the open market. So, as a homeowner, you pay additional taxes. In return, however, in your tax return you are allowed to deduct what you spend on your home in mortgage interest and maintenance costs from your income.

- Wealth tax: Swiss residents pay taxes on their wealth, including the property they own. Property assets are typically valued at a value around 80% of their market value.

For the sake of this article, we assume that one lives in Basel-Stadt and is required to pay the property tax. Thus for a house worth 1.5 million, the current rental value is ~ 4,000 CHF / month. Discounting this value to 3,000 CHF/month the imputed yearly tax comes to 36,000 CHF / month. This 36,000 CHF is added to income when declaring yearly taxes.

As stated earlier, the mortgage payments can be used to offset income for tax purposes. Thus, given a 1% interest rate on a mortage of 1.2 million, one could deduct 12,000 CHF from income. Historically however, interest rates have been around 3-4% making the interest payments actually reduce income for tax purposes!

Amortization options

In Switzerland, one needs to repay 15% of the mortgage during the first 15 years. Thus, every year 1% of the value of the mortgage (not the value of the house) will get removed from the loan. Consequently, the interest will decrease over time for the first 15 years.

Most interestingly as stated initially, one is allowed to keep 65% of the mortgage potentially indefinitely. Do note that this is heavily dependent upon one's personal financial situation and their bank. It is quite possible that at retirement, the bank decides that the income situation has changed and that the mortgage needs to be reduced, i.e. require more downpayment.

- Direct amortization: this is a simple method where you just pay cash to reduce the principal. This in turn reduces the interest payments as the years progress.

- Indirect amortization: this generally works via a 3rd pillar account. Instead of just repaying the money, one invests that amount into a 3rd pillar account. If you fail to pay your interest, then the bank has a right to these funds. Otherwise, at the end of the mortgage term, the bank will use the money to pay off the principal. Note that for indirect amortization, the principal is not reduced and the interest payments remain the same per year.

- Depending on the bank, one might be forced into using a cash-only 3rd pillar account.

- In the case that one is offered an equity 3rd pillar account, they need to ensure that the return on equity is more than the rate of interest.

In general, given the low mortgage rates, it makes sense to delay amortization and invest the money where one can obtain a higher rate of return. This is also what companies and businesses do, take loans from the bank and use the interest payments to offset taxes. Given that most businesses plan to stick around forever, it makes no sense for them to ever repay the loan. The banks are happy for the source of fixed income as well.

- The interest rates rise: liquidity is very important here as one needs to be able to service the mortgage at a new rate. Given that in Switzerland, one generally gets a 10 or 15 year mortgage they could find themselves requiring extra capital in case that the rates have risen over the 5% mark.

- The house value drops: while a lower risk but this can cause significant trouble if the value of the house drops which means that the debt to capital ratio changes and the bank comes knocking to ask for another downpayment.

- Interest payments cannot be deducted anymore: this will kill off any tax optimization and will likely never happen.

To summarize, once you have bought a house, it can be beneficial to keep the debt and use the money to generate a higher return than the loan interest payment.

Selling property

Depending upon the bank, if you sell a house and buy a new one, they might let you transfer the actual mortgage to the new house. Based on the value of the new house, you may have to add some cash again to the deal. In general, this can be done during the duration of the mortgage and one does not have to wait until the renewal of the contract.

If you do not buy any new property, then the mortgage contract would need to be canceled and this can come with significant penalties. Read the fine print!

Indefinite mortgages

At every point of mortgage renewal, the bank will generally re-assess the financial situation and depending upon the circumstances it could be that one is forced to sell their property. Thus, it is essential to plan for retirement (when income drops significantly) and make sure that one can continue to afford to live in their house!

The simplest option here is to pay off the loan so that it reaches a reasonable level. Another option is to sell the house to the children (if any). The children can also act as guarantors, i.e. they promise to take over the debt.

Conclusion

Despite a low interest rate environment, it is prudent to start saving and putting money aside to start whittling down the mortgage to a manageable level. A mix of stocks and cash is recommended and flexibility is key. As an example, 1% amortization and 1% interest on 1,2 million CHF is ~ 2,400 CHF/month. However, it makes sense to calculate ~ 4,000 / month with the extra 1,600 / month (19,200 / year) going towards saving up for the mortgage. This money can be invested in stocks but the goal should be to cut the mortgage by 100,000 CHF every 5 years or so! Such a scenario will cut a 1.2 million CHF mortgage down to ~ 700,000 by the end of 15 years, leaving a lot of breathing space for different eventualities :).