- Setup:

- A random selection of companies are in the game providing gameplay variability. 18India, the map is divided into regions with companies picked from these regions thereby enabling a bit more varied track development. Also, 18India features guarantee companies that pay out a certain small amount even if they do not pay a dividend thereby maintaining stock value.

- Stock operations:

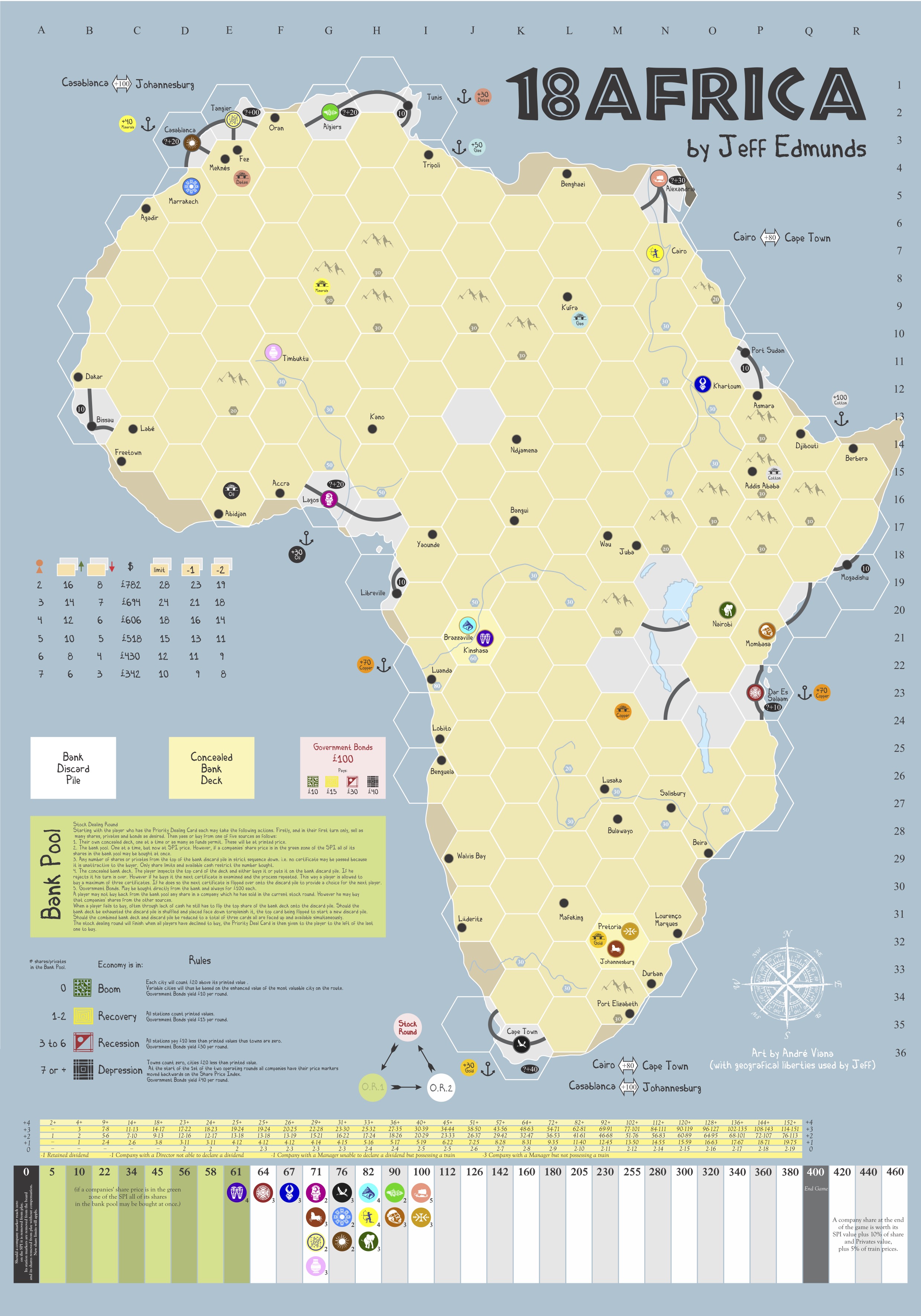

- Players have a hidden hand of certificates from which they can purchase shares or from the IPO. There is an initial draft to seed one's hand and a certain number of certificates are thereafter drafted/auctioned off. In 18India, the remaining certificates are then laid out on top of each other in 3 different piles to form the IPO. Thus, the location of most of the certificates can be assessed. In 18India, there is also a small number of certificates in the initial bankpool providing a small starting incentive for some companies. Note that the presidencies are set aside and are always drafted/auctioned off. Players may buy up to 2 open shares from an IPO stack. 18Africa takes a more chaotic route with the IPO all in one stack face-down. Players may choose to flip a certificate, choose to purchase it, and thereafter flip another certificate and purchase it for a maximum of 3 purchases. Every pass action results in a certificate being flipped/exposed. Players may also simply buy any number of exposed certificates as an action but they all need to be bought in order. Should the bank deck be exhausted the discard pile is shuffled and placed face down to replenish it, the top card being flipped to start a new discard pile. Should the combined bank deck and discard pile be reduced to a total of three cards all are faced up and available simultaneously. In both titles, players may also buy a single certificate from the pool and pay the market price for that company / listed price for the private.

- In 18Africa, when playing certificates from the hand, one may play as many as they would like. In 18India, one may play any number of certificates of a single company only.

- Incremental capitalisation with fixed par values. Whenever a share is purchased from the IPO or a player's hand, the company gets that capital.

- Companies float with just the presidency or if there are 3 individual shares out (either in players' hands or in the pool). Companies with a director's certificate in play are referred to as directed companies and those without are managed companies. In case a company floats during an OR it starts operating the subsequent OR. The manager is the first player to play the company certificate. Companies may never manage/direct other companies. In 18India, the game starts with a few certificates in the pool leading to a small boost for certain companies.

- May only sell once per turn as a first action, may only buy thereafter. May never sell the presidency however, the presidency may be transferred if there is another player with 20% or more holdings. There are no ownership limits and players can hold 100% of a company. May however buy back what was sold. In 18Africa, A player may not buy back from the bank pool any share in a company which they have sold in the current stock round. However, they may buy shares in the same company either from their hand or purchase from the IPO. In 18India, the first round of every SR is a selling round followed by buying rounds. Thus, 18India provides more information to players regarding capital.

- In 18Africa, priority changes to the left of the last player to take an action. 18India features priority-order passing.

- Trains:

- No train rusting. Companies are not required to own a train and there is no forced train purchase. The trains are quite funky with the early trains being standard but late trains allowing skipping dits, taking the best 4 cities, double the value of cities, recession-proof trains, etc.

- Train limit is always 2 and trains may be sold back to the bank (early trains can be sold for close to 100% of face-value). More expensive trains have a lower resale value. In 18India companies are limited to only one phase 4 train.

- In 18Africa companies may only purchase 1 train from the bank per OR but may purchase multiple trains from other companies. In 18India companies may purchase multiple trains from the bank however a train that is bought from the bank may not be sold back to the bank in that same OR. Thus, both titles prevent cycling of trains in order to quickly buy more expensive trains even if companies have enough capital.

- In 18India trains may hit multiple revenue locations on OO and triple-town tiles (providing a legal route exists) with the exception of Mumbai. Nepal is also eligible to be hit twice.

- In 18India express trains may count all 4 cities that do not contain any token as long as such a legal route exists. Moreover, tokens are also not required to collect the location connection bonuses.

- Track:

- All track tiles are available from the start regardless of train phase, however track upgrades must follow progression: yellow -> green -> brown -> gray.

- Companies may lay 4 contiguous pieces of yellow track or 1 upgrade. Towns may be upgraded to cities. In 18Africa, track may only be laid from one location in a contiguous line and track building stops the moment one hits/lays a city or lays a sharp curve/town. In 18Africa connecting cities with track for the first time provides companies with a bonus which is the value of each city connected. An important point to note is that in 18Africa, companies starting in OO locations may upgrade their home to green as a yellow track lay and continue from there. Another very important point to note is that in 18Africa companies may not lay city upgrades if they do not have a train (this makes running shell companies a lot more tricky). Finally, in 18Africa to upgrade a town or city tile the company must have a train with the nominal capacity to reach that tile. 18India features gauge changes which count as 0-value cities, making running routes slightly more difficult at the start of the game. However, track and tokens may be freely laid across gauge changes.

- Towns may be upgraded into green cities. In 18Africa, only a few green cities allow upgrading all the way to grey and others do not. In 18India, towns are upgraded to single location green cities however they upgrade to a regular double city brown tile.

- Revenue:

- Towns are free, i.e. do not count as a stop, however trains are required to run from a city to a city, i.e. a city + town is not a valid route.

- Both titles feature variable value cities that generally add between 10-40 to the highest value city on the route. These are generally located on the edges of the map and are very lucrative locations. A route with a +40 and a gray 60 can clear 160 with a 2T. There are also certain north-south and east-west bonuses.

- Stock movement:

- The stock market is linear and company stock only moves if a company pays out or withholds with 4x jumps possible.

- 18India features guarantee companies that do not fall-back for a 0 payout. Instead shareholders get paid 5% of the current stock value as compensation. However, if a company ends its turn trainless it falls back 1 space. Thus, trainless regular companies fall back 2 spaces and trainless guarantee companies fall back 1 space.

- In 18Africa, trainless managed companies fall back 3 spaces.

- If companies fall too far back, they close taking their tokens out of the game. Assets are returned to the bank pool. Certificate limits are adjusted down and shares are eliminated without compensation. In 18India, the relevant certificates are also removed from the IPO.

- Company stock actions:

- Companies may purchase certificates from the bank pool. In 18India they may also purchase from the IPO and are limited to 3 certificates and may only ever hold 1 share of each company. In 18India they are allowed to purchase their own certificate from the bank pool however they may not purchase their own certificate from the IPO. In 18Africa, companies may never purchase their own certificates but do not have a certificate limit.

- In 18India companies may also buy a bond as a single action and in phase IV may convert 1 bond into a GIPR share paying the difference as a single action. However, the GIPR may not convert a bond (likely due to the fact that since a company may own multiple bonds, converting them could lead to multiple shares of itself).

- 18Africa also has a concept of economy:

- Boom: This is when there is no share or private in the Bank Pool. Each city will count £20 above its printed value. Variable cities will thus be based on the enhanced value of the most valuable city on the route. Government Bonds yield £10 per round.

- Recovery: When there are 1 or 2 shares/privates in the Bank Pool. All stations count printed values and Government Bonds yield £15 per round.

- Recession: Occurs when there are 3,4,5 or 6 shares or privates in the Bank Pool. All stations pay £10 less than printed values thus towns are zero. Govt. Bonds yield £30 per round.

- Depression: Occurs when there are 7 or more shares or privates in the Bank Pool. Towns count zero, cities £20 less than printed value. At the start of the first of the two operating rounds all companies have their price markers moved backwards on the Share Price Index. Govt. Bonds yield £40 per round.

- Note that the game always starts the first 2 operating rounds in Recovery. However, a very interesting aspect here is that the economy takes effect immediately. i.e. a company might operate and sell a share into the bank pool thereby affecting the runs of everything operating after it!

- The final value of a company includes a percentage of the value of its assets. In 18India this is = Current stock value + ((face value of trains + face value of privates + sum of all certificate stock values + company cash) / 10) rounded down. In 18Africa you add 5% of the face value of trains (rounded down) + 10% of certificate stock values and private face values (rounded down) to the current stock value to get the final calculated stock value. Thus, a company valued at 300/share with 1 share of a 90/share company gets +9 along with say +30 for a 300 value train and +60 for a 600 value train bringing the total to 399/share in 18India. If it had 11 in the treasury this would make it an even 400/share.

- Both titles feature privates but in 18India the privates are slightly better as they can be closed to get the money back during operation or also simply sold back into the pool, whereas in 18Africa they do not close and may be sold to the bank pool but this also affects the economy.

- Both 18India and 18Africa feature Government Bonds which do not count against certificate limit and pay out a certain value per OR. In 18Africa, this value is tied to the economy and the bonds are worth 100 each at the end of the game. In 18India these bonds may be converted into shares of the GIPR by paying the difference. The GIPR is a special company without a presidency but with 10 10% regular shares and 10 potential bond conversions bringing the total to 20 10% shares. When it floats, it picks any empty spot on the map and the majority shareholder operates this company.

- Both 18India and 18Africa feature concessions, which are bonus values for running particular routes. In 18India the first company to run a route with a concession token thereafter gets the ability to claim that bonus if it runs that route again. In 18Africa, there is an auction after the 2nd OR (i.e. just before SR2) for the right to pick a concession.

18India & 18Africa - Notes and strategy

November 1, 2023

18India/18Africa are board games that belong to the family of 18xx games. The goal of both the games is building railroads on a map, running fictitious trains to generate money and using the money to either enrich investors or re-investing it by upgrading the network, buying better trains etc. Players are investors in different railroad companies with the majority investor then performing operations on the board on behalf of that company. The richest player (money + assets) at the end of the game wins.

With the release of 18India a group of us took a weekend off to play a few games as well as a few games of 18Africa on which 18India is based. All in all, 18India is a fun game but I personally believe that it is perhaps a bit too sanitized for my taste in comparison to 18Africa.

General gameplay

The following is a gameplay summary for someone experienced with full-capitalization and incremental-capitalization 18xx titles. Differences are color coded.

Both 18India and 18Africa look like they are very operationally heavy games and it is true that a lot of player interaction is on the map. However, given that sales are only allowed at the start of one's turn, managing one's portfolio is critical to winning the game. Here are some strategy tips that worked for our group.

18Africa - start

Given that 18Africa starts out with the first 2 rounds alway in Recovery, the best start is to grab a couple of bonds since they pay $15/round. Moreover, since one can only buy 1 train/OR, you'd also want to float a company with 3-shares to start building track asap. Since one can only play certificates from their hand in the first SR, buying bonds allows one to sell them in the second SR and start foraging from the IPO for some more interesting options.

18Africa also has a tighter map with only single token spots on the map edges. It is therefore essential for companies to get early funding and get a second train. If the economy is in boom (which is highly likely at the start), players should shoot for companies that can reach one of the variable cities quickly and token them.

Finally, note that having some money left over in SR1 is not a bad thing as one can price-enforce certain concessions which are auctioned prior to SR2 (before any selling has happened). Thus, bonds come in handy here again as they provide the most bang for your buck.

High-ownership, low-par + high-par, low-ownership

- Buy shares: for a low-par company buying shares will provide some capital but at 74/share the maximum it can make here is 740.

- Withhold: planning for the future is necessary and some withholding at critical junctions might be wise.

- Loot other companies: This the best approach and the trick here is to float a high par company with say 3 individual certificates and then funnel that money into another company which you own more than 50% of. Once the shell has been sufficiently looted it can be dumped in the SR and a new pig can be found. Moreover, if the shell is nearby, it can lay valuable track/upgrades for its buddy.

18India with its open IPO makes it easier to run shell companies whereas there are always some risks in 18Africa as it is quite possible that due to some unfavorable IPO flips, a company gets stolen. In 18India, the GIPR is a viable backup plan as one can always dump shares of a mediocre company and go all-in on the GIPR. It fires up with a lot of cash, tokens to spare and can start making 800+ off the bat, thereby encouraging even more investment.

High-par, high ownership

A company with an IPO of 90+ can get significant cash into its treasury with 4-5 shares sold. This in turn can help it take off early thereby potentially encouraging further investment, or if the president can pull it off, high-ownership. Such a company can make some great early money which the president can use to start other companies or simply cross-invest. Note that in 18India it is easier to keep jumping up on the stock market so simply paying out with 2 trains for 5-6 ORs is a viable strategy.

High ownership

When all else fails, the goal ideally should be to get high ownership of a company. This encourages one to make that company amazing and will definitely attract investment, i.e. players holding 1 or 2 shares will want to play them to get a piece of the action. Since early money is critical, getting early investment is amazing and that is why as a president you want to fund your company to the max as soon as possible.

Similarly, it might be wise to not let someone collect a lot of a single company in the initial draft/auction. This has the added advantage of denying them early capital and if they do make an amazing company, there is nothing like playing the last share of a company valued at 300+ for 70 odd bucks.

In both titles every company has a fixed starting location there are some not so great companies which will be readily chucked in the initial draft. An interesting strategy here is to shoot for that company as the obvious plan and keep a backup plan in your hand. Moreover, in 18India there is a private company that allows a company to place a station marker for free in any city even if it is completely blocked thereby allowing just about any company to become amazing.

Shells only

In both 18India and 18Africa, having the presidency is a very valuable thing as it provides the flexibility of maintaining ownership. If one has say 70% of a company including the presidency, it might be wise to first play the five 10% shares and keep the option of being able to get rid of the shell if required! Sometimes just having 3 certificates in play might encourage others to steal it which could result in some free capital! Note that the first person to get a majority will then get the president's certificate if it enters play.

Conversely, if one does have 70% of a company, then it might be difficult to find another high-ownership candidate. Ideally, you'd want to run a shell with 40-50% in play but with information on where the other shares are.

Route destruction

Apart from the standard tokening, players also have some agency in destroying juicy routes by upgrading towns to cities and then tokening them, forcing companies to waste valuable track points building around. In 18Africa there are even two types of green cities, one that allows upgrading all the way to gray tiles and one that stops in green. 18Africa also has some really restrictive tiles and with some careful planning, it is possible to completely wall-off companies which can be extremely frustrating.

18Africa - Manipulating the economy

In 18Africa, having a high and a low par company is great as one can buy up a couple of certificates with the last operating company leading to a boom for the lead company. The lead company can then dump a certificate back into the pool to make the world miserable for the rest of the companies :). This is best done with a couple of cheap privates.

18Africa - Endgame

In 18Africa, it is very hard to run shells as later companies have a hard time getting access to existing network. Moreover, the fact that there are only 3 recession-proof trains, means that there will be people at the table who would be looking to buy out things from the market. Since cash in companies does not contribute to stock value, companies are also incentivised to buy certificates from the market and/or upgrade trains. Thus, one needs to factor this into account when shooting for a depression economy strategy and/or plan to buy out certificates which greatly boost one's stock-value and thereby net-worth.

18India vs. 18Africa

The goal of 18India was to minimize the randomness of 18Africa and the designers mostly succeeded. However, to my opinion, a few of the levers that a losing player could pull are missing in 18India making it a fairly sanitized run-good-companies game. For example, the economy in 18Africa is a great lever that can be pulled to make the world terrible until one pivots to a different plan. 18India does have a more balanced company distribution however in our games since getting early track built is so critical, a lot of companies clustered up in one region anyways. A lot of companies even from across the board made a beeline to the hotspot and tokened there.

Due to the lack of economy in 18India, it plays a lot faster and therefore requires a lot more skill in timing the right train purchases and payouts. The first company in 18India to get the 4E is usually going to get a lot of concessions however, the first company to get one of the phase-IV trains in 18Africa is the one that will bring home the bacon. In both titles, preference should be given to trains first shares second. However, in 18India buying early shares of potentially good companies out of the IPO can easily contribute to a big permanent train by mid-game.

All-in-all my current preference is for 18Africa or even 18India with 18Africa rules. I would like to experiment with having a partially open IPO, e.g. maybe have 3 closed stacks with the first certificate open from each stack to increase a bit of choice. Admittedly, 18Africa does have the problem that one can have a runaway winner if they manage to steal a company and/or get funding from other players. Given that the presidencies are always out in 18India, chances that everyone gets a decent start are higher. I am also quite curious to see how both the titles play out at 2P :).

Many thanks to Ot, Boris & Tom for a wonderful weekend and for reviewing the article. Added more strategy notes after playing a few games of both titles at the Mechelen 18xx convention in Spring 2024 :).