- In 18CO, companies are incremental-cap, i.e. shares bought from the treasury inject money into the company as well as paying out dividends. Shares in the market do not pay out to anyone.

-

18CO features 3 different classes of companies:

- C-class companies require 40% sold to float and are generally the ones to start the game. The potential par values for C class companies range from $40 to $75 / share.

- B-class companies require 50% sold to float and arrive mid-game. Par values range from $80 to $110.

- A-class companies require 60% sold to float and arrive later in the game. Their par values range from $120 to $160 / share.

- Lower class companies may be floated at a higher class par value with the caveat that the requirement for the number of shares sold to float is adjusted accordingly. E.g. a C-class could be started at $120/share provided that 6 shares are sold.

- A higher class company may not be floated at a lower class par value.

-

Stock Round actions are Sell then Buy.

- Selling a single share does not affect stock price unless it is the president selling the share.

- Selling more than 1 share will initiate a vertical drop in stock price based on the number of shares sold.

-

When a company operates it does the following actions in order:

- Redeem its shares from the market (if any).

- Buy shares of a single company either from the market and/or from the president’s hand 1 share at a time up to the president’s share (unless a transfer of presidency to another player is possible).

- Lay track and token.

- Run trains: a payout greater than the share price will move the stock diagonally to the right, moves 1 step right otherwise. Withholding will move the stock to the to the left in the market.

- Buy trains. Note that the 4D train is available right after the first 5 train has been bought. Also, the 5D & E trains are available right when the first 6 is bought.

- Issue shares (if any): A company may issue shares from its treasury into the market 1 at a time with the stock value dropping 1 level for each share issued.

- Sell shares of companies which were not purchased in this turn (if any). Note that these share sales work like normal sales where selling more than 1 share will result in a price drop. The operating order is fixed at the the start of the OR however, so the effect of share price change will only be applied in the subsequent OR.

- Laying track in this game is very restrictive. When upgrading, a company may only lay track if it can use the new section of track and if it has access to both ends of the track.

18CO - an exercise in screwing over your investors

February 17, 2021

18CO: Rock & Stock is a board-game that belongs to the family of 18xx games, most of which are based on an economic engine. The general idea is to build a network and then use this network to earn money which can then be re-invested to build a better network thereby netting out bigger profits. 18xx games are called as such because they focus on the early 19th century when railroads were being developed around the world. Some games are titled with a particular year but most focus on a particular region in the world with the companies and the geography of that period. Players participate in starting railroad companies and building a rail network as best as they see fit.

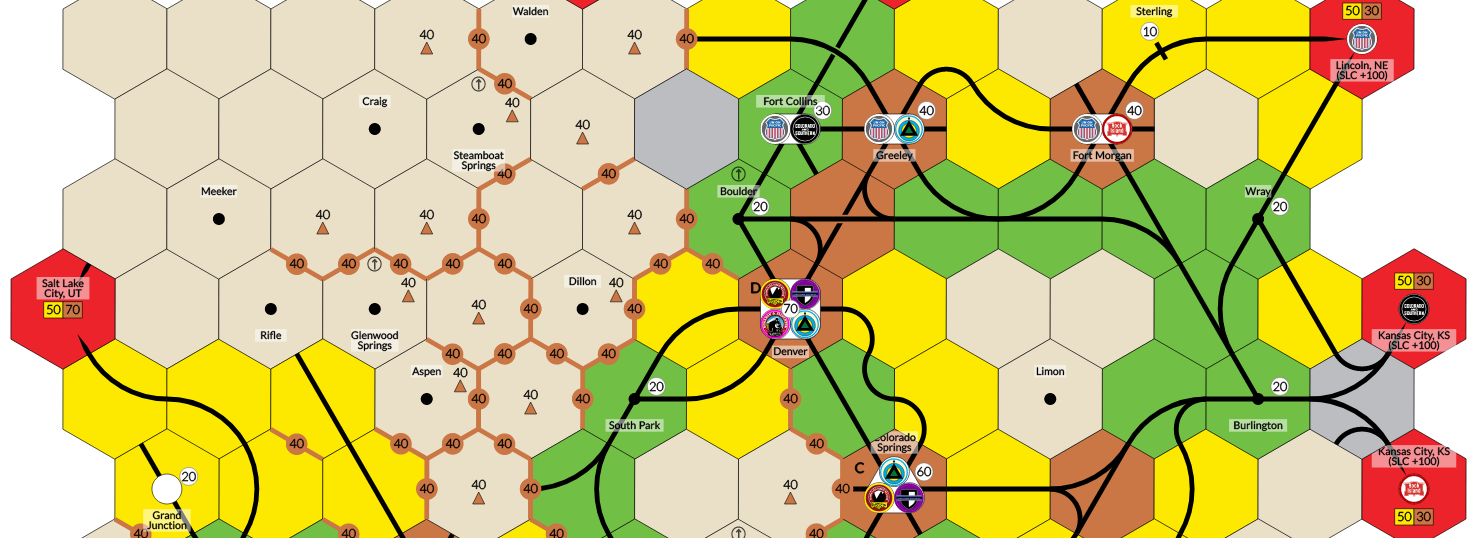

18CO takes place in Colorado when there was a massive expansion of railways trying to head west through the mountains and the board reflects that. Most companies start in the east with the goal of heading to Salt Lake city in the West for a tasty $100 east-west bonus. 18CO is a very well designed game and features lots of shenanigans. Moreover, the game is also fairly imbalanced in certain aspects and requires a few plays to fully grasp the various strategies that can lead to either fiscal boom or ruin. In this article, we will go over some of the basic rules and thereafter look at some strategies and their counters. Note that while this article is intended for those that have some experience with 18xx titles under their belt, players new to the genre might also benefit from some general advice.

Some important rules

Company takeovers (aka eating)

A company takeover happens when a company becomes the president of another company. When this happens the new company gets to take upto 2 tokens from the company being absorbed and they are replaced with tokens from the rightmost space on the charter, i.e. the more expensive tokens. The new owner also acquires all assets from the child company except for money from the treasury. If the child company had any shares of other companies then they are put in the open market with their monetary value being added to the treasury. The treasury money of the child company is then evenly distributed to all shareholders of that company.

A company takeover is the heart and soul of this game with the general strategy being that one wants to start a C-class company and then have it eaten with a bigger company so that the bigger company gets access to the network and can run the bigger / better trains. There are however some very important points to note about the takeover.

As mentioned previously if the president owns 40% of a company it cannot be sold to another company because the presidency may not be sold. Thus the buying company may only buy upto 2 shares. While the presidency may not be sold, if another player were to have shares in their hand, a transfer of presidency to another player is possible during the buying shares step, e.g. A has 40% of DPAC and B has 30% of DPAC and A starts selling DPAC shares to ATSF then after selling 2 shares B becomes the president of DPAC after 2 shares have been sold since ATSF has 2, A has 2 and B has 3. Thus, A may then continue to sell the last 2 shares allowing ATSF to absorb DPAC!

Finally, note that if a company has 20% of another company and the president only has the president’s certificate, they may sell their 2 shares in the SR allowing their company to be absorbed. Of course, they may sell as many shares as they would like provided some entity is able to take over the presidency. In case of ties, the priority goes to players first and then to companies in operating order.

The initial auction

The initial auction features a bunch of privates out of which the mining company (P1) and the fat ones (P6 & P7) being the most interesting. The others can also be valuable depending on which company one is able to start and synergies matter a lot. Most importantly however, capital is tight and it is quite possible to win the game with no privates and starting 2 companies off the bat. The reason for this is that company takeovers are a powerful mechanism with which one can extract money from a company and put it in a player’s hand. This functions similar to the private buy-in and this is why the fatter privates are more valuable. P6 comes with a share which can provide immediate value depending upon the company in question and the DSNG is a special case which we will look at later.

- P1: ~$40

- P2: ~$40

- P3: ~$60

- P4: ~$65

- P5: ~$80

- P6: if with DPAC ~$135, if with KPAC ~$130, if with CM ~$125, ~$120 otherwise.

- P7: ~$145

Note that due to the explosion of money and stock value in this game, bidding up privates and being over-privatized by buying too many can be a very dangerous situation as it locks up capital and does not allow one to extract that cash via a company. Thus, it is not uncommon to see privates go for face value. P6 and P7 should ideally be bid up a bit however.

The DSNG

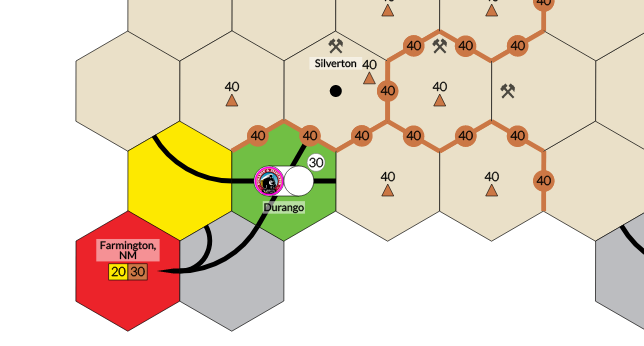

The DSNG is a special private that is essentially the presidency of the DSNG. It floats right away at a $75 par price and gets $150 in starting capital. It also comes with a permanent 2 train that may not be sold to another company. As long as the DSNG does not pay out, the private pays $25. Note that due to the initial plain yellow tile, the DSNG may only run a route when the green tiles are available. However, there are other ways of getting DSNG to operate sooner than that.

A common strategy is to float a company and then have DSNG buy 2 shares of that company off the bat. In SR2 one can then sell the presidency and get DSNG to take over 1 of the tokens to get going right away. One can either buy shares from the president’s hand in the first OR or buy a 2 train and then buy the train out for all the treasury money and let the DSNG buy 2 shares from the president in the second OR. Note that due to the fact that the DSNG comes with only 2 tokens, combining it with either the DSL, DPAC or the CM is good. DSL works the best because one can build track to connect both Durango and Denver as well as collecting all the mines along the way.

Another strategy is to float a company high enough that it goes right after the DSNG. The DSNG can then buy a train and issue shares at the end of its turn allowing the company to take it over and run right off the bat with the trains. Note that if the DSNG goes for cheap this might be a viable strategy.

A counter to this strategy might be to buy either the DSNG or buy up 2 shares of the target company. Do note that whoever does this will likely be taking a bit of a hit as the DSNG shares do not pay out and investing in the target will make it extremely likely that it gets absorbed at the first opportunity. The reason for this is that if the DSNG player has pulled ~100 in cash back into their hand along with the private and share payouts, it is very difficult to attack both the DSNG and the target company. In both cases, the result is that both the attacker and the DSNG holder lose out thereby ceding position to the others at the table.

The good news is that the DSNG player can be safely left alone as there are generally other more worthwhile shares to be bought in SR2 (the answer is always DPAC). Given that the DSNG player has a lot of cash to invest, they will likely be going last in SR3 and that is when they can potentially be attacked depending upon whether they are in contention for the win or not.

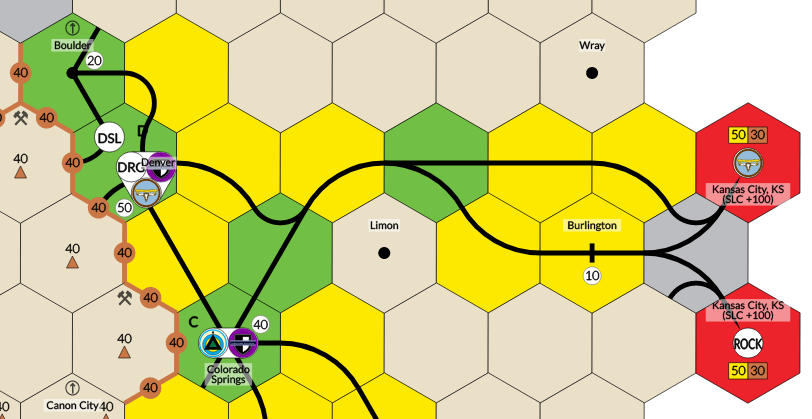

SR1 and initial locations

Selecting a company in the first stock round is a very important decision as not all companies are balanced to begin with. The DPAC is the best company and will generally be the first one to start. Thus, having priority coming out of the initial auction is also something to be considered. The KPAC is also a great starting company but it would require some help in getting a token in either Denver or Colorado Springs. Depending upon which/how many companies start, it might be useful for KPAC to forego the initial $110 run by going north and instead just head to the middle right off the bat. CM is a great company but suffers from some low initial runs. To be effective it requires that the greens hit and therefore it needs to be well-capitalized in order to be able to push the trains. DSL can be decent if it gets help from the DPAC which is generally also in DPAC’s interest as it can save its own token for Colorado Springs. Finally, the CS also works well if it is well-capitalized and can push the trains and/or gets a token in Colorado Springs as soon as the greens hit but it usually suffers from being the worst C-class company in the game due to its initial position.

Advanced strategies

Double running trains aka the rocket

If one is the president of 2 companies, they can set it up so that the company that goes after their first, eats it by buying the shares out of their hand and since they get the assets right away, they can get to run the trains again! This works best when floating a new company that can eat the old company and shoot right out of the gate instead of the initial move left one space due to lack of trains and a $0 payout. Moreover, this can also be a very effective strategy to get rid of a train liability if there is an imminent train rush.

The reverse takeover aka properly screwing over your investors

Given that a president of a company that has all of its shares out in either player hands or in the market is looking to get rid of it, it might be that players sell it down and pile into the same president’s new company expecting a takeover and juicy payouts. As the president in this situation, depending upon operating order, one could potentially steal a non-rusting train from the old company for all the fresh $$$, let the old company redeem shares and then buy-out the newly floated company and continue to run its network and trains since the president now controls 100% of the old company vs. only 50-60% of the newly floated one.

Note that there are some disadvantages to doing the reverse takeover, namely that the higher class companies generally have more tokens and one might thus be losing out on future track building and tokening by keeping an existing lower class company.

There is however, another strategy to simply eating and that involves a bit more planning but can be highly lucrative. See below for the double company poison pill.

Double company poison pill

- It puts money back into the president’s hand.

- New company gets access to the old company’s network and trains.

- It runs right away and shares in hand payout right away.

- Loss of shares that could have paid out (unless eating a company in the 2nd OR that has already run).

- Loss of 20% share value of the company being eaten (the presidency).

- Loss of track lay opportunities since each company gets to lay either 2 yellow or 1 yellow and 1 upgrade.

- President gets payout for all the shares in hand. Technically if a newly floated company did the takeover, the president might have gotten a 2x payout for the first company but if the newly floated company has some decent routes it can run on its own without requiring to eat, then this is a much more lucrative option.

- President controls 90-100% of the old company. The old company pays out into the new company’s treasury and if it gets another train, it can really boost revenues given that it has a great network already built.

- President enjoys a 4x share value appreciation (assuming a 2x jump per OR) and can complete the merger in the subsequent SR and get the full value of all of their shares without the 20% presidency share value loss.

If both companies are looking like they are doing well then another advanced option is to get the second company to also buy a couple of shares of the first so that both companies are cross-invested in each other. This allows the president to run a double poison pill for another set of ORs. Do note that due to the train rush, running a poison pill for too long might also slowly limit options as other companies could have all been started making the merger infeasible and/or not worthwhile.

Stock trashing and locking companies

As explained earlier, if a company’s shares are split between players with the president owning a clear majority of them, the president can buy the company out with another one of their companies as the presidency can shift between player hands. Thus, to ensure that someone does not buy out a company that one is invested in, one needs to keep 40% of the company in another company. With a 60-40 split, the moment that the president were to sell the 3rd share, the company that has 40% will take it over. This is called locking a company up.

- Start withholding to buy and donate trains to another one of their companies. The disadvantage here is that the president denies themselves payouts for 50-60% of shares in their hand to deny another company 40% or so in funding.

- Run the company for the rest of the round and sell it out in the next SR when its train is about to rust. Of course, by selling out, the disadvantage they have is that they lose out on the tokens and network but if by letting it go with a rusting train, they get the liquidity to then attack the attacker, it might be worthwhile to do so. Moreover, if the buying company did spend a fair amount in locking up, it loses its investment and source of funding!

Closely linked with locking companies is stock trashing which is another aggressive move. Given the steep vertical drop in value when more than 2 shares of a company are sold, it can happen that a newly floated corporation gets trashed to $45/share before it has even had the chance to operate! While this is not so worthwhile as one is forced to capitalize a newly floated company, trashing C-class companies that have run their course is generally what happens in SR3. A company sitting at ~$50/share with 4 shares in the market is then ripe for locking up by one of the competition. Thus, trashing companies to jockey for operating order is a big part of the mid-game.

Note that as a president of a company, one does want their company’s shares to be split between investors as that increases the options of being able to buy the company out. Conversely, when cross-investing one should try to target one specific company as that increases the chances of being able to lock it up and getting a valuable source of income.

An advanced strategy involves engineering 2 companies going back to back with the first one having collected 2 or more shares of a competitor. The first company then trashes the shares at the end of its turn and the second company picks them back up. This is then repeated the next OR with the second company trashing the shares into the market again for a total of 4x drop in stock value during the ORs!

Liquidity

18CO is similar to 1817 where liquidity matters more than value. It is more important to have money in the SR than having value by way of shares in companies. Money allows one to manipulate share value and most importantly, jockey for turn order which can make or break the game. Thus, while it may be lucrative to attack other companies early on, note that one needs to also keep injecting cash into their own company by way of share purchases otherwise they will contribute to their opponents being able to buy more trains in their companies which will allow them to put more money back into their hands by way of bigger payouts.

In a SR, trashing companies even if a few steps and then eating those very shares in the subsequent SR can also be a very profitable move. Moreover, at the end of the second OR, those very shares can then be sold into the market again for another 2 step drop in stock value which can potentially kill off one or more opponents by denying them the liquidity they are looking for in the upcoming SR, be it by way of share sales and/or issuing shares to buy in privates.

Optional rules

- Priority Order Pass: In this option, priority is awarded in pass order in both Auction and Stock Rounds. Given the importance of being able to start a corporation, going first in the next SR can be a huge advantage. This rule ensures that one gives up priority if they are looking to do a lot of shenanigans and is recommended to use if playing with experienced players.

- Pay Per Trash: This rule makes selling multiple shares before a corporation's first Operating Round return the amount listed in each movement down on the market, starting at the current share price. Thus, trashing a newly floated corporation incurs a small fee. It probably will not do much to deter a determined adversary but it is a good option to use when playing nonetheless.

- Major Investors: With this option turned on, the Presidency cannot be transferred to another player during the corporate share buying step. I cannot recommend this rule as it takes out all of the liability in cross-investing, which in my opinion makes the whole game. However, at 5-6 player counts, cross-investing is pretty much required and this rule should be employed.

Final notes

18CO is a very interesting game with a lot of shenanigans taking place and is not for the faint of heart. While similar to 1817, it is sharper than its peer and requires a few plays to get the basic mechanics and location valuations down, not to mention the restrictive track laying rules. Playing with experienced players can be immensely frustrating as they will make full use of their liquidity to smash their competitors into the ground over and over again. Due to the fact that normal 18xx encourages one to stake out their positions as soon as possible during the SR, 18CO actually encourages one to hold off and see what the table is doing before they start making their play. Liquidity matters a lot as one has many more options if they are not worried about trying to maintain their stock value. Once one can wrap their head around it however, this is a very rich game with great strategic depth and I can highly recommend investing the time into it!